So who are the 47% Mitt Romney refers to? You might be surprised.

So who are the 47% Mitt Romney refers to? You might be surprised.

As determined by the non-partisan Tax Policy Center, 162,000 people among the top 10% of earners in the United States have found ways to avoid paying any federal income tax. This includes approximately 3,000 people in the top 0.1%, a group that makes $2,178,886 per year or more.

It is also interesting to note exactly who created Romney’s 47%. As per the Tax Policy Center, there have been conscious efforts made to create policy to remove low-income families from income tax roles, one of the largest being the Earned Income Tax Credit.

“Based on an idea (the negative income tax) originated by conservative icon Milton Friedman, the EITC is refundable, so that people who work for low wages can not only wipe out their income tax liability, they can even get a cash payment from the government. The EITC was enacted in 1975 under President Ford, greatly expanded in 1986 under President Reagan, and expanded again under presidents Clinton and Bush (both of them).” SOURCE

It is noteworthy that “in Reagan’s last few years in office, the percentage of households not paying taxes jumped by more than 10%. Under Bush, it increased by more than 25%.” SOURCE

Additionally, as Ezra Klein explains in The Washington Post, many tax cuts for the poor were enacted to make tax cuts for the rich “more politically palatable.”

Possibly the most interesting aspect of it all was reported by the Daily Finance who noted that:

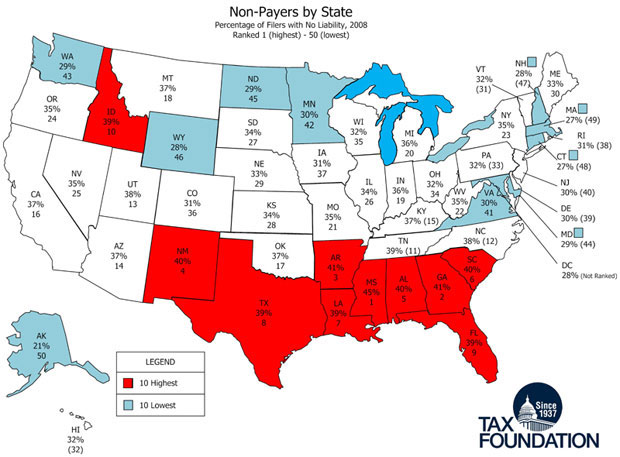

“The fact that Romney’s party largely created the 47% isn’t the only irony in his attacks. Perhaps more striking is the fact that an outsized percentage of the 47% live in “red states.” Of the 10 states with the highest percentage of income tax nonpayers, only one — New Mexico — is leaning toward Obama right now. Meanwhile, of the 10 states with the lowest percentage of income tax nonpayers, only two — North Dakota and Wyoming — skew right.

And therein lies perhaps the strangest aspect of Romney’s complaint. Not only does he not seem to understand the group that he’s discussing or the way that it was created, but his final statement, that “these are people who pay no income tax … My job is not to worry about those people,” directly contradicts the electoral map. The choir that he’s preaching to actually contains a large percentage of the very people that he just wrote off.”

In the video below, University of Miami Law School Professor Frances Hill analyzes GOP presidential candidate Mitt Romney’s claim that 47% percent of Americans pay no federal income taxes.

You must be logged in to post a comment Login